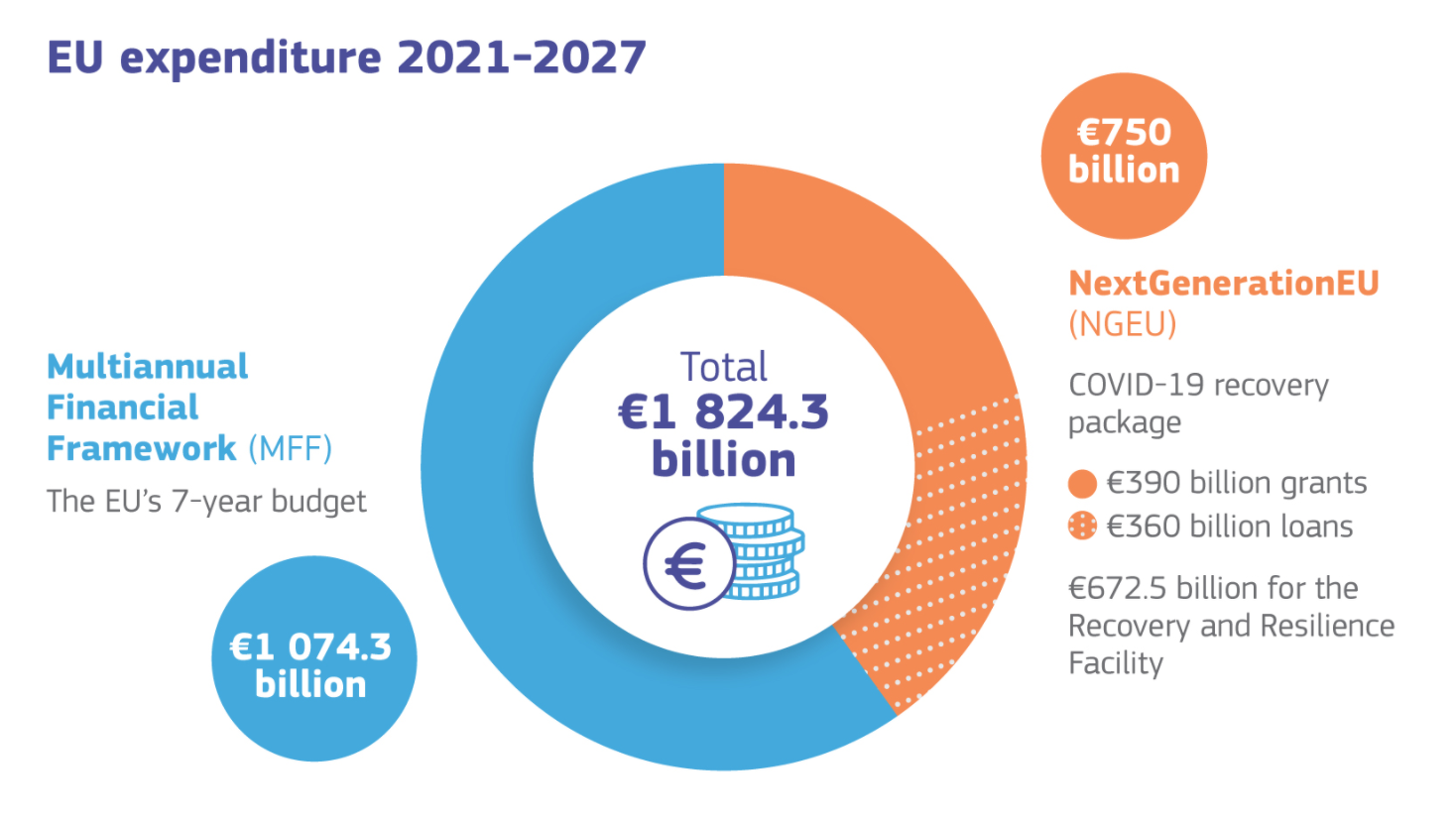

The EU has outlined its approach to economic and social damage brought about by COVID-19 and defined its temporary instrument to boost economic recovery which is coupled with its long-term budget. The European Commission, the European Parliament and EU leaders have established the plan that will lead the way out of the crisis and lay the foundations for a modern and more sustainable Europe: the Next Generation EU (NGEU). A €750 billion plan agreed by EU leaders with a €672.5 billion Recovery and Resilience Facility, the largest stimulus package ever to be advanced through the EU budget.

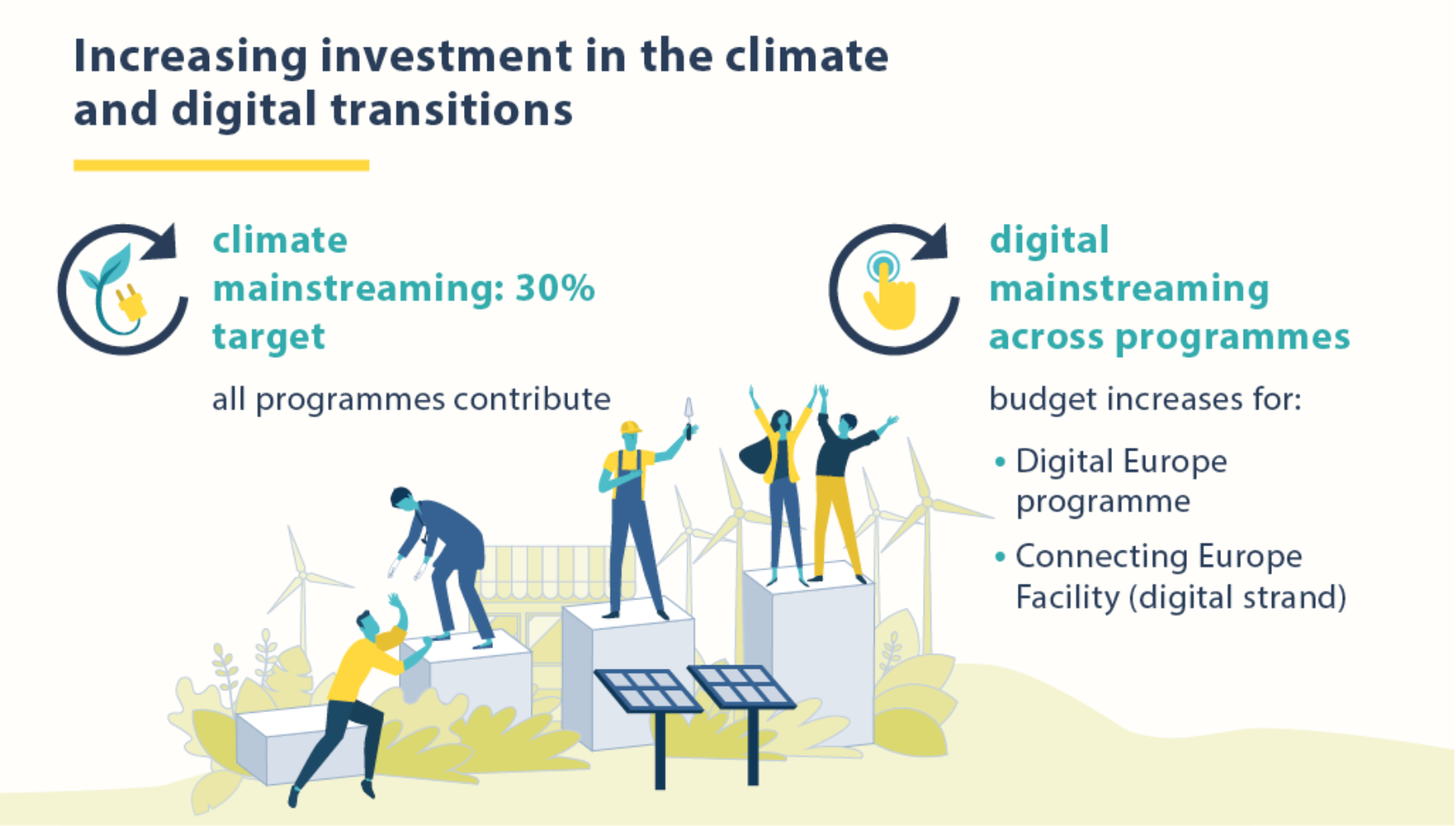

Most significantly, a large part of the budget is being tied to modernization and climate goals through research and innovation, via Horizon Europe, and fair climate and digital transitions, via the Just Transition Fund and the Digital Europe Programme.

Around 30% of the EU funds have to be invested in projects and initiatives that contribute to the fight against climate change, the highest share ever of a European budget. In this way, EU policymakers are truly looking towards building a future for the next generations.

How it works and why it’s important

The €750bn Next Generation EU programme will finance itself exclusively through capital markets. Its first bond will be issued in June, after which it will remain a regular issuer until 2026.

This will have a lasting effect on bond markets in Europe due to the fund’s focus on environmental, political and macroeconomic targets. Gert-Jan Koopman, the European Commission’s director-general for the European Union budget, recognised the program’s potential not only as a funding instrument but also in its capacity to “build and strengthen the environmental, social and governance capital market [and] bolster the international role of the euro and demonstrate the cohesiveness and robustness of the euro area.”

2⃣ #SURE & #NextGenerationEU confirm it: they are about making Europe greener, more digital, more social.

3⃣ @EU_Commission is issuing #SURE as social bonds, 30% of NGEU financing should be green bonds. Stay tuned for the details!

Full video is 👉 https://t.co/tiUyP26TYf pic.twitter.com/TsI8mxMfoT

— Gert Jan Koopman (@GertJanEU) March 5, 2021

Due to the total issuance target of about €800bn, the Next Generation EU could be borrowing up to €160bn per annum over the next five years. “It is only natural that our funding mix reflects the green and social model which is in the DNA of the EU’s policy-making,” continues Koopman when commenting on the fact that 30% of these will be green bonds.

The volume of funds will make Next Generation EU Europe’s largest non-sovereign public sector issuer and the pacesetter for sustainable funding. By way of comparison in 2020 the EU’s two largest sovereign, supranational and agency borrowers, EIB and KfW, raised a little over €15bn between them in green, climate and sustainability bonds. Next Generation EU will raise over three times that amount in each year of its life.

At the beginning of March 2021, a provisional agreement between Parliament and Council was reached and sets the framework for how the funds for the Connecting Europe Facility (CEF) will be used from 2021 to 2027. The programme will fund transport, energy and digital projects, and ensure that essential Trans-European projects, such as Rail Baltica, alternative fuels charging infrastructure and the roll-out of 5G coverage to important transport axes are finished by 2030.

The positive impacts of the Next Generation EU program are already being seen. Just last week Fitch Ratings published in a new report in which they revised Bulgaria’s Rating Outlook – from Stable to Positive – due to the prospect of substantial funding for investment for Bulgaria from the European Union implicit in the program.

“Fitch believes EU funds will support Bulgaria’s macroeconomic outlook, lifting growth from a projected 3% in 2021 to 4/5% in 2022-2025,” says Federico Barriga Salazar, director at Fitch Ratings.

Securing funding requires climate action

To ensure that member states implement green policies the EU has tied access to recovery funds to detailed spending plans that put recipients in line with Europe’s strategic vision for the future. This means ensuring that a green economy, digitalisation, and social inclusion are integral to plans set out by member states so that the debt generated with the spending packages brings positive prospects for future generations.

In terms of actual policies, this means investments in environmentally friendly technologies, clean transport, decarbonisation of the energy sector, and ensuring the energy efficiency of buildings.

To secure funding, member states have to share their final spending plan by April 30, 2021, which sets out their reform and spending agendas until 2026. To date, only 19 countries have submitted a draft of the document, which will have to be updated, submitted, and reviewed by the end of April.

Our plan #NextGenerationEU will give all Europeans a chance to recover from the crisis.

But for funds to start flowing, EU countries must first ratify the Own Resources Decision.

7 have done so. I invite all EU countries to follow suit, fast.

— Ursula von der Leyen (@vonderleyen) February 22, 2021

Climate change still a priority in Europe

Notwithstanding the pandemic, it is clear that in Europe climate change is still a priority for policymakers and the population alike. The yearly Eurobarometer survey of the European Parliament, conducted between November and December 2020, gives a clear indication of the impacts of the pandemic on public perceptions but also of the continued concerns regarding climate change.

Almost half of the respondents (48%) declared that the fight against poverty should be the top priority for European policymakers, which amounts to a 17% increase compared to the last edition of the survey – a result which has been attributed to the effects of the pandemic. At the same time, protection of the environment and biodiversity has not decreased since the previous year. 32% of respondents regard climate change as a top priority which still makes it a major concern for European citizens, particularly when considering that 2020 was dominated by the OVID crisis.

“In the 2019 Parameter, combating climate change and preserving the environment, oceans and biodiversity ranked as the highest priority. This year, a similar proportion (around a third) prioritise measures to protect the environment and biodiversity,” states the report.

Linking economic recovery to a green transition is therefore paramount and governments are responding to these concerns. In Italy, the newly elected prime minister, Mario Draghi, has created a new ministry for green transition, whereas France committed a third of its €100bn recovery plan to the green transition.