When fog forms and blocks your view, it is hard to make decisions. Immersed in uncertainty, a driver proceeds slowly, on his toes, and ready to avoid sudden obstacles, trying to reduce risks by foreseeing unexpected events.

As long as uncertainty linked to the pandemic is clouding the near future, and managed with public finance that targets short-term measures and immediate recovery packages, it is essential for the world of business to keep an eye on future risks in an attempt to unravel the fog. Attracting external investment is vital for companies, and investors prefer to have a clear view. Preparation through risk awareness, adopting strategies that tackle foreseen risks and providing transparent information on how they are going to be managed are crucial steps for companies that want to stay in the game, facing future challenges effectively and showing themselves to be reliable for investors in an era of uncertainty.

What is clear today is that climate change is recognized as the greatest of such challenges. The latest Global Risk Report – built on a survey that assesses the global risk perception of the World Economic Forum’s multistakeholder community – ranks the failure of climate change mitigation and adaption as number one among long-term risks by impact.

I believe we are on the edge of a fundamental reshaping of finance.

Larry Fink, Chairman and Chief Executive Officer, Blackrock group

Climate change is going to affect economic growth, asset values and financial markets. Successful organizations are those that manage to factor climate challenge into their strategies, both in terms of building long-term resilience to the expected risks and in terms of mitigating the impacts of their operations on the climate and the environment. This is how they will improve their competitiveness, become more attractive for investors, lenders and insurers, and will not be left behind in a word that is moving on a sustainable development path, in a framework designed by the Paris Agreement and the 2030 Agenda for Sustainable Development.

A deep transformation is taking shape

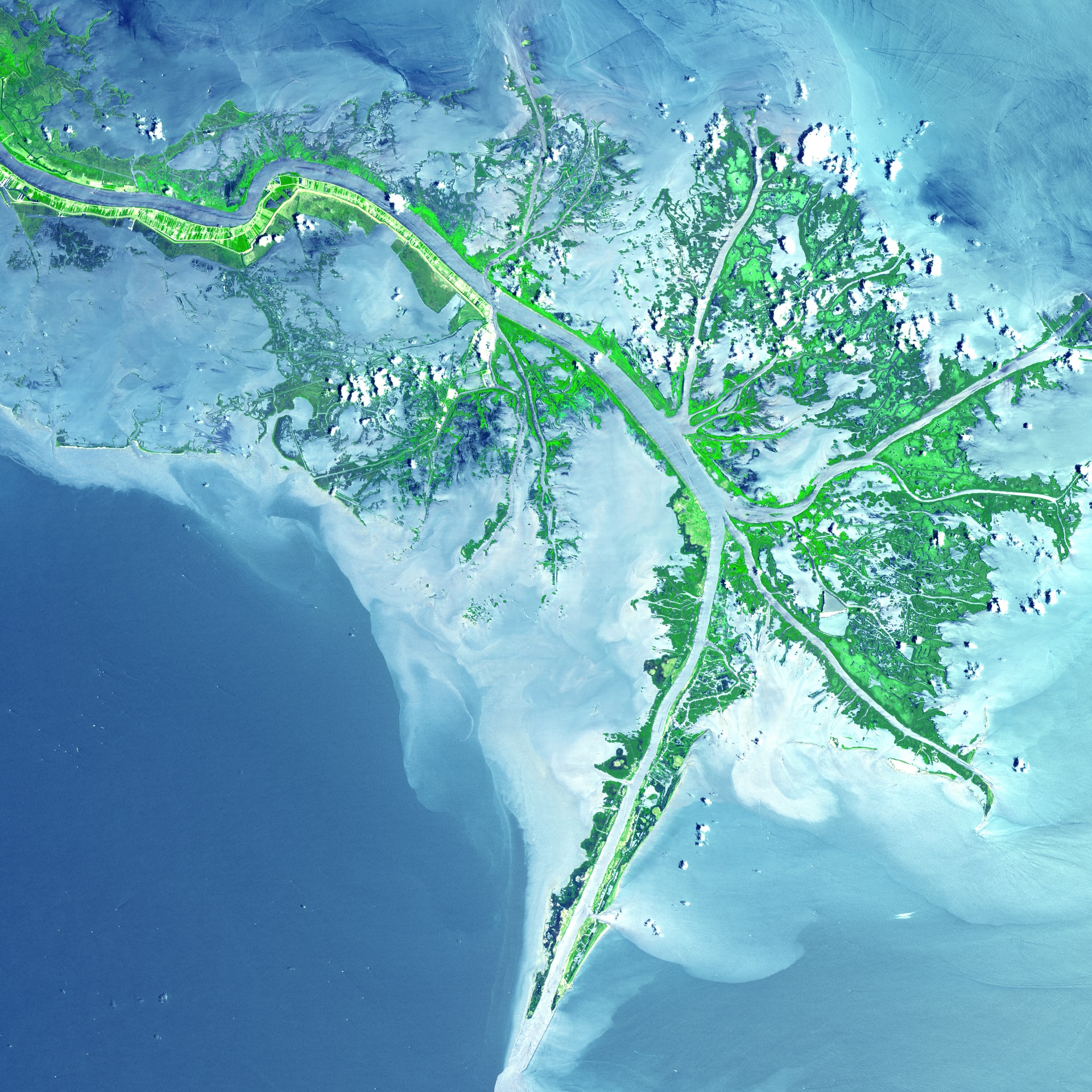

Climate change poses physical risks that have economic and financial effects on businesses and organizations. Linked either to extreme weather events – such as storms, floods or heatwaves – or to slow-onset events – such as sea-level rise or increasing temperatures – the physical impacts of climate change can affect organizations’ premises, operations and safety. “Climate impacts can affect companies also through their supply chains, which might be interrupted by extreme events damaging suppliers and cause cascade effects on several market players, even when they are settled in different countries and contexts of the world,” explains Jaroslav Mysiak, Director of the Risk Assessment and Adaptation Strategies at the CMCC Foundation. “Information on how climate risks are managed is critical for firms to build resilient chains and for investors to take optimal financial decisions.”

Insurances transform uncertainty into certainty.

Jaroslav Mysiak, Director, Risk Assessment and Adaptation Strategies, CMCC Foundation

Climate sciences show how dangerous the impacts of climate change will be according to different emissions scenarios. Depending on how fast and effective the global transition to a lower-carbon economy will be, the world could warm by a minimum of 1.5°C and up to more than 4°C by the end of the century, causing different grades of physical consequences. In any case, climate change is driving a deep transformation in our world and our societies. On the one hand, in a world without (or with low) climate action, the physical impacts of climate change will be extreme. On the other hand, the more we align with the Paris Agreement goal of keeping global warming to well below 2°C and pursuing efforts to limit it to 1.5°C, the more in depth the world and its economic system will change in both appearance and priorities, thus exposing organizations to a different type of risk: the transition risk.

Climate change is a financial risk

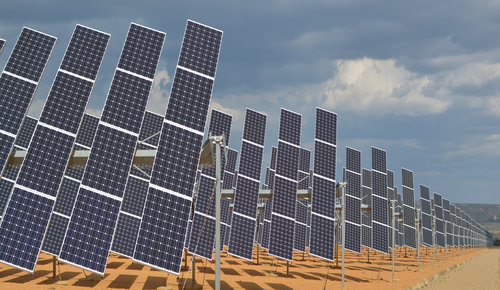

Climate action is driving a transition that is going to affect most economic sectors and shape a different global economic growth. As the world goes green, companies that do not undertake a sustainable development path will be penalized. Besides physical risks, the Task Force on Climate-related Financial Disclosures (TCFD) identifies the “transition risks”. New and more stringent climate policies can have effects on organizations’ operations, on their supply and distribution chains. New and cheaper lower-carbon technologies will displace traditional systems, affect the competitiveness of certain organizations, their production and distribution costs.

The market is changing, with the demand for different products and services reflecting a rising awareness and concern on the topic, which may also have an impact on the reputation of organizations. This transformation is having financial implications for everyone, and especially for high carbon firms, for those organizations that depend on fossil fuel energy and for those who do not keep up with the change, who will encounter a higher cost of capital. On the flip side, many opportunities arise for those who accept these challenges as part of the transformation and act in order to identify, measure, manage and disclose their climate risks.

A paradigm shift

“I believe we are on the edge of a fundamental reshaping of finance”. These are the words that Larry Fink, Chairman and Chief Executive Officer of Blackrock group, the world’s largest asset manager, wrote last January in a letter to CEOs from all over the world. “In the near future – and sooner than most anticipate – there will be a significant reallocation of capital.”

We are making sustainability integral to the way BlackRock manages risk, constructs portfolios, designs products, and engages with companies. Learn more in Larry Fink’s Letter to CEOs: https://t.co/QfcYgwa21I #BLKSustainability pic.twitter.com/m6ebuJ2FhK

— BlackRock (@blackrock) January 17, 2020

Pressure from the world of finance is multiplying. In the same letter, Blackrock warned they will vote against management and board directors of companies of which they are shareholders when they do not make sufficient progress on sustainability-related disclosures and the business practices and plans underlying them. A few months before, Christopher Hohn, founder of the hedge fund TCI Fund Management, threatened to do the same against those “which do not publicly disclose all of their emissions and do not have a credible plan for their reduction.”

Insurance companies also have a role in the transition. “Insurances transform uncertainty into certainty. This is their core business: policyholders buy certainty by paying premiums to them” explains Mysiak. “Therefore, insurances become big institutional investors and, as such, they allocate their capital in accordance with environmental, social, and governance (ESG) factors. Moreover, they can incentivize climate risk management by rewarding policyholders’ risk reduction measures by lowering the premiums and deductibles.”

The Paris Agreement has triggered this mechanism, and now it is the financial world that is driving the change. A change that won’t stop.

Andrea Maggiani, CEO, Carbonsink

The active role and strong pressure of investors is the real engine of the change according to Andrea Maggiani, founder and CEO at Carbon Sink, a highly specialized Italian consulting firm designing climate risk management and sustainability strategies for the private sector. “What we are seeing is a paradigm shift,” he affirms. “Climate action by the private sector is not a matter of reputation, positioning, or marketing anymore. The perspective has changed. Now, it is about competitiveness, it is about financial survival. It is about building long-term resilience to the climate challenge to manage economic and operational risks, and disclose climate-related information in order to keep being attractive for investors.”

Climate-risk disclosure

How can organizations identify and disclose their climate-related financial risks to get aligned to such requests?

The Recommendations of the Task Force on Climate-Related Financial Disclosures, established in 2015 by the Financial Stability Board and chaired by Michael R. Bloomberg, provided an important boost to transparency by defining a globally recognized framework for more effective climate-related disclosures for use by companies, banks, and investors in providing information to stakeholders. The Recommendations are structured around four core elements of how organizations operate: governance, strategy, risk management, and metrics and targets (see figure below). Today, over 110 regulators and governmental entities from around the world support the TCFD, and nearly 60% of the world’s 100 largest public companies support and/or report in line with the TCFD recommendations, according to the TCFD Status Report.

We’ve seen a tectonic shift in the availability of environmental data. Environmental disclosure has become mainstream and ESG data is now a lucrative market, soon to be worth $1 billion.

Steven Tebbe, head of CDP in Europe

Blackrock’s letter explicitly asked companies that they invest in disclosure in line with the TCFD’s recommendations, which are also integrated into the EC Guidelines on reporting climate-related information. Such guidelines, together with a series of other instruments, are part of the Commission’s action plan on financing sustainable growth adopted in 2018.

The importance of data

Data resulting from disclosure is crucial for stakeholders. “We’ve seen a tectonic shift in the availability of environmental data. Environmental disclosure has become mainstream and ESG data is now a lucrative market, soon to be worth $1 billion. Through our global disclosure system, we have the most comprehensive collection of self-reported environmental data in the world”, says Steven Tebbe, head of CDP in Europe. CDP, formerly Carbon Disclosure Project, is considered the gold standard of environmental reporting. They collect information on climate risks and low carbon opportunities from the world’s largest companies on behalf of institutional investors and, on the basis of the collected data, they score companies according to their sustainability. “20 years ago, 35 investors used CDP to request climate data from 500 companies, and 245 responded. Today 10,000 companies, cities, states and regions are using CDP to respond to their investors, customers, governments and the public. CDP data powers the ESG data ecosystem, and is used by a range of financial products like stock indices funds and tools” explains Tebbe.

“For example, the STOXX Global Climate Change Leaders index is made up of the approximately 200 companies that score an A through CDP for climate. Euronext runs a series of environmental indices using CDP climate, forest and water scores, which Goldman Sachs uses for structured investment products. Data is also used for Climetrics, a free-to-search database of nearly 20,000 funds based on their exposure to environmental risks, run by CDP.”

Not just about compliance

The implementation of climate-related disclosure, being mainly a voluntary mechanism and not just a compliance means, can represent a measure of the players’ awareness about the ongoing transition. More than 1000 companies worldwide are adhering to the Science Based Target Initiative developed by CDP, Global Compact, WWF and WRI to involve companies in setting climate targets in line with the scientific knowledge available on the topic. As big players move in this direction, they are imitated by competitors and followers and impact their supply chains.

Companies risk US$1 trillion in climate impacts.

That’s why 137 global financial institutions including @Amundi_ENG and @HSBC are urging companies to set 1.5°C aligned @sciencetargets: https://t.co/vPRzatl8eG #InvestorAction pic.twitter.com/FhglQG3J0d

— CDP (@CDP) October 20, 2020

“We are monitoring how the main Italian companies mature their perception of climate change risks year after year, and we can understand this trend observing their behavior in disclosure,” continues Maggiani.

“Our recent analysis shows that there is still a lot to do, as only 20% of the Italian companies listed on FTSE MIB align with the TCFD recommendations. The weakest aspect is the ‘governance’ dimension: it is rare to find climate experts in Italian companies’ boards of directors. Nevertheless, the journey has begun, it is global, and it does not depend anymore on public regulations only. The COVID-19 pandemic could have been an excuse to back away from climate action. Instead, the attention remains high on sustainability because actors understand the importance of being prepared for future risks. The Paris Agreement has triggered this mechanism, and now it is the financial world that is driving the change. A change that won’t stop. The matter is: how fast will this transition happen?”

The business sector is center-stage in shaping a low carbon world, as the world’s sustainability goals will be enabled by the technological change and innovation developed by firms, but the public sector must keep fuelling this big change. “Policy and regulation can play a vital role in accelerating companies’ efforts,” concludes Tebbe. “We can expect, in the near future, much faster and more impactful progress on mandatory disclosure. The UK recently announced it will make TCFD disclosure obligatory.

This year we’ve also seen much more discussion about the need for harmonized reporting standards, which CDP supports. The EU, for example, is developing non-financial reporting standards as it builds on its regulatory framework for corporate reporting. This move is to be celebrated, and it’s key for delivering markets with consistent and universal minimum standards of information. In the long-run, this move will help to keep a green recovery from COVID on track and fulfill the policy direction of the European Green Deal.”

🆕The Platform on #SustainableFinance is coming to life!

Meet the 50 experts who will join forces with the @EU_Commission to help us take forward #EUTaxonomy & #SustainableFinanceEU for a #ClimateNeutralEU 🌱

List https://t.co/wucVRePYi4

FAQs https://t.co/8YdrPvvSME #EUGreenDeal pic.twitter.com/BrbPIQD5GU— EU Climate Action (@EUClimateAction) October 1, 2020