Among the crucial themes in all the latest climate conferences, climate finance undoubtedly stands out. On the opening day of the UN Climate Summit in Dubai, COP28, Carlo Carraro, a member of the CMCC Strategic Committee, Professor at Ca’ Foscari University of Venice, and a member of the Bureau of the Intergovernmental Panel on Climate Change (IPCC), highlights the three dimensions at play when discussing climate funding: the ‘how much’, the ‘how’, and the ‘where’.

The glass is only half full

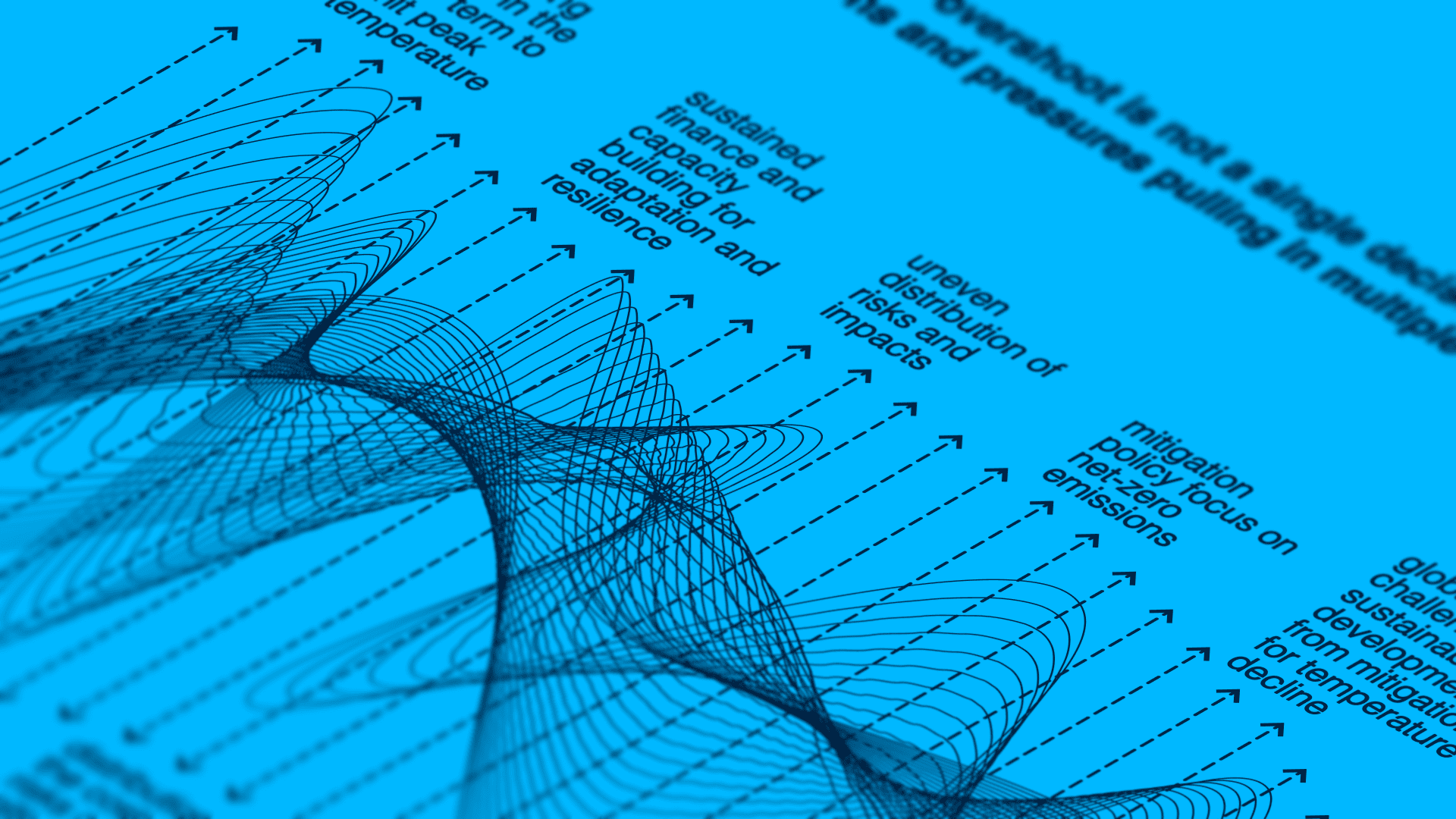

“The developed countries have never fulfilled the commitment made at COP15 in Copenhagen in 2009 to allocate $100 billion annually for activities aimed at mitigating climate change and/or adapting to it in developing countries,” explains Carraro. “This year, in 2023, we will most likely reach this $100 billion threshold, albeit with a significant delay compared to the commitment made, which still remains a drop in the ocean. Hence, it is important to discuss this issue. On the one hand, because we are achieving an important goal – the $100 billion per year in contributions. On the other hand, because it is still a largely insufficient amount. The estimates we know today, also based on the latest IPCC report, tell us that the needs are much higher, in the range of $3,000 to $3,500 billion annually. Fortunately, there is not only the Climate Fund identified and agreed upon at COP15 in Copenhagen: there are many other funds and resources. The CPI – Climate Policy Initiative – has just published a report estimating current investments in climate finance at $1.1 trillion per year, roughly half from private sources and the other half from public sources. Therefore, those $100 billion finally reached are intended as a share of these $1.1 trillion that are annually allocated to finance investments to reduce emissions or adapt to climate change. Although this figure is very significant and has rapidly grown – multiplied by ten over ten years – we are far from the amounts needed to make all the investments required to achieve the goal of staying within one and a half degrees by the end of the century in terms of temperature increase. And this is an extremely difficult goal: the Global Stocktake of this COP28 will also highlight this significant gap. The global average temperature has already warmed by 1.3 degrees, and the warming will definitely reach 1.5 degrees by 2034, so it is likely that we will surpass this threshold. However, it is necessary to remain as close as possible to 1.5 degrees. To do so, investments are needed, and funding for these investments requires climate finance. The glass is half full: $1.1 trillion is an enormous figure that goes in the right direction. The half-empty part is because this figure is still insufficient to finance the investments that would be needed.”

More resources are needed for adaptation and for developing countries

Alongside the need to increase resources allocated to climate finance, the issue of their distribution continues to emerge. “The distribution of resources is still highly unfair, and it is unfair in two ways,” says Carraro. “Firstly, because it is strongly focused on mitigation investments, that is, on reducing emissions, and too little (only 10%) on adaptation. Given the effects that climate change is already having in many areas of the planet, it is crucial to have more resources to invest in protection, prevention, in defending against the impacts of climate change.

The second element of inequity lies in the fact that the majority of these resources are still invested in developed countries. Only 20% is allocated to developing countries, which, on the contrary, need it the most, both because they are more vulnerable to climate change and because they lack the technologies and infrastructures to reduce emissions. It is in these countries that more investment is necessary to try to guide them along a less polluting development path, less impactful on the climate than the one we have followed for many years. If this does not happen, the impacts would be significant not only on the local populations of these countries but also – through the impacts on economic growth, trade, migrations, natural resources – on all other countries on the planet. The distribution of resources is extremely important and is a topic of great interest in the negotiations that will take place in the coming days.”

Climate finance to support competitive businesses

This theme links to the side event “Climate mitigation and adaptation through science-technology diffusion and entrepreneurship development in Mediterranean and African regions,” organized by CMCC on December 2nd at COP28, in collaboration with Ca’ Foscari University of Venice and the Union for the Mediterranean. A panel of experts, including Prof. Carraro, will discuss climate adaptation, finance and innovation for entrepreneurship. “These are the three ingredients we need, especially in developing countries,” explains Carraro. “Climate finance should focus on investments for adaptation – and at the event, we will see which ones are the priority – in the most vulnerable countries. It should primarily play the role of a catalyst for economic growth. It should help to grow new businesses and entrepreneurial initiatives in developing countries, particularly in Africa, where growth is slower than elsewhere, and where there is a greater need to develop both technological and entrepreneurial innovation. We will analyze how these resources can be used to assist young startups, accompanying them not only with training programs but also with innovation pathways towards starting new businesses that can be financed and supported by climate finance funds, aiming for market success that makes this investment stable and economically sustainable. The goal is to seek threefold sustainability: environmental sustainability in terms of reducing the impacts of climate change, social sustainability in terms of increased employment, training, and better living conditions in these countries, as well as economic sustainability. We are talking about new businesses that will remain in the market because they are capable of being competitive both nationally and internationally.”

More on climate finance: