The category 5 Hurricane Katrina struck land in Florida and Louisiana in 2005, bringing extensive damage to the city of New Orleans and causing over 1,200 deaths: the deadliest United States hurricane since 1928. Not only were the homes and livelihoods of millions of people affected, with over one million people displaced, but Katrina also had pervasive economic effects, leading the Federal Deposit Insurance Corporation (FIDC) to report that 10% of banks in the area suffered net losses and almost 50% felt the brunt of the storm thorough net losses on loans. In fact, the FIDC stated in the aftermath that: “From a financial standpoint, the biggest source of uncertainty and concern for Gulf Coast financial institutions is the effect of the post-hurricane damage on credit quality”.

Although it is inaccurate to attribute single extreme weather events to climate change, it is accurate to state that climate change leads to an increased frequency of such events. Hurricane Katrina is just one of many examples of the profound repercussions that extreme weather can have on financial institutions, whereby extreme weather impacts the stability of banks and the financial sector as a whole. Therefore, it is important to focus the efforts of both policymakers and academic research on understanding how financial institutions are exposed to climate risks and what they can do in response.

The effects of climate change on the financial sector

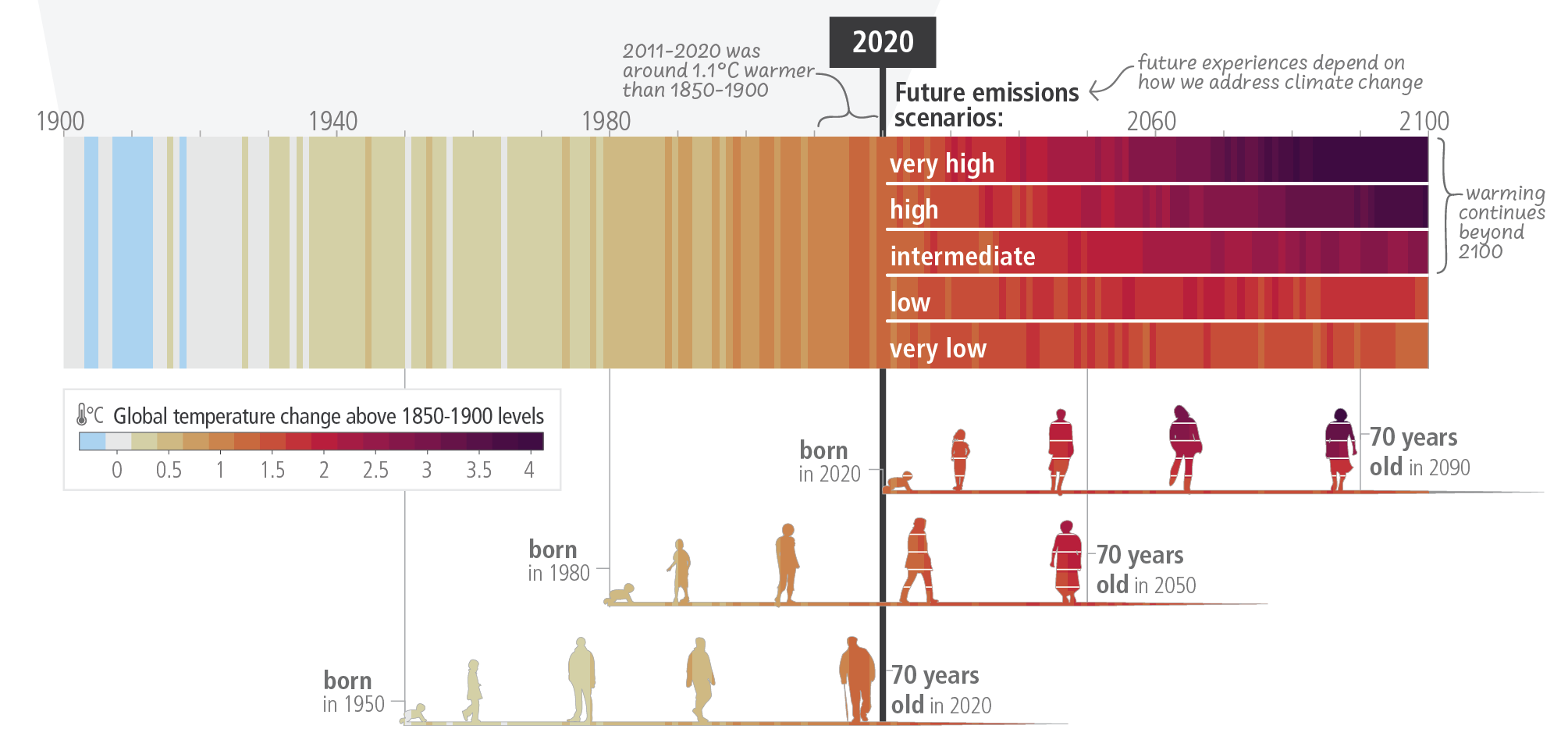

An influential report, published by the scientific journal Nature Climate Change, and entitled “The public costs of climate induced financial instability”, addresses the role of the financial sector in dealing with the consequences of climate change on production activities. Francesco Lamperti, co-author of the paper and post-doctoral research fellow at the Institute of Economics, Scuola Superiore Sant’Anna and junior scientist at the European Institute on Economics and the Environment (RFF & CMCC), explains that the “paper provides robust evidence on the role of financial sector in absorbing or exacerbating the losses and damages that climate change exerts on production activities.” Lamperti further elaborates by highlighting how: “On one side, we show that climate change might have negative impacts on the stability of banks, with long-run consequences for governments, public debt and future generations. On the other, our paper points to the fact that when banks are under stress because of cumulating losses, they reduce credit provision to businesses and real activities thus exacerbating the negative effects of climate change.”

Although the paper in no way claims to be able to predict when and where climate induced financial crises will occur, it does give an indication of the mechanisms that bring about these crises, leading to the conclusion that climate change goes hand in hand with increased probability of financial crises.

Specifically, an increase in climate-related extreme events, including floods and storms, would put infrastructure at risk and hence affect banks and insurance companies, and in turn raise premiums. In fact, the report states that climate change increases the frequency of banking crises (from +26% up to 248%) while rescuing insolvent banks will cause an additional fiscal burden of approximately 5% to 15% of GDP per year and an increase of public debt to GDP by a factor of 2 in the year 2100.

“The main result”, explains co-author Massimo Tavoni, director of RFF-CMCC European Institute on Economics and the Environment and professor at Politecnico di Milano, “is that climate damages significantly reverberate to the financial system: our results clearly show that firms’ survival likelihood reduces almost three times, while the risk of banking crises doubles.”

The effects on the financial system have also been reported by other sources. In a recent Bloomberg Environment article, the idea that “climate change makes investments riskier, blunts workers’ productivity, and shakes up monetary stability” was also reported and discussed by prominent economists.

Federal Reserve Chairman Jerome Powell, outlined how extreme weather events “have the potential to inflict serious damage on the lives of individuals and families, devastate local economies (including financial institutions), and even temporarily affect national economic output and employment.” In fact, in the US alone it is estimated that damage from severe weather has impacted insurers substantially, costing them upwards of $50 billion in 2018, explained San Francisco Federal Reserve Bank President Mary Daly. “This impacts banks’ customers, making it harder for them to satisfy their loan obligations,” Daly continued. “And this can ultimately stress banks’ balance sheets. So, ensuring financial institutions are regularly evaluating their exposure to climate-related risks is an increasingly important part of our work.”

Financial regulation can make a difference

But it isn’t all bad news. The report also chooses to focus on the possible measures that financial regulation authorities can implement to manage and reduce climate-related risks, therefore providing valuable insight for policymakers and suggestions for future academic research.

In particular, monetary policy, and macroprudential regulation are outlined as effective tools with which to mitigate such risks. According to co-author Lamperti: “banks exposed towards clients that are located in areas at high risk of climate-related impacts might be requested to increase their capital and liquidity requirements. This is similar to what recent advances in macroprudential regulation foresee for periods of excessive credit growth: when the supply of credit excessively increases with respect to real economic activities (production), the risk that some – potentially many – of these loans won’t be repaid rises as well, and banks are thus requested to increase the amount of capital (equity) they need to hold relative to their total assets. A similar mechanism might be designed to account for climate risks.”

The financial sector must be accounted for in climate-economy integrated assessment as its omission may lead to an underestimation of climate impacts. Furthermore, financial regulation can play a central role in mitigating these impacts and creating a more resilient global economy that can implement effective climate change mitigation and adaptation strategies.