The consequences of rising temperatures are becoming ever more obvious as more frequent and intense extreme events, such as floods, storm surges, and wildfires continue to threaten people and their livelihoods. At the same time, insurance policies that offer coverage against climate-related hazards are not keeping up with the pace of change, both in terms of affordability and availability.

One of the most well-documented examples is that of the wildfires in Los Angeles, California, which caused a total estimated damage of around 250 billion USD, in an area that had already been experiencing extensive issues with insurance coverage prior to the January 2025 events.

The issue of insurance coverage in at-risk areas is by no means unique to California: over the past few years, America’s home insurance market has seen providers pull back with over 1.9 million home insurance contracts being denied renewal since 2018 alone.

“From a purely technical and mathematical standpoint, climate change is making it increasingly difficult to insure the risks posed by extreme events as they become more damaging, more frequent, and more variable,” says CMCC researcher Stefano Ceolotto, whose work on projects such as PIISA and NATURANCE highlight CMCC’s contributions to advancing innovative insurance solutions. “Insurance companies are increasingly interested in novel solutions and adaptation as it is in their interest to reduce exposure to risks and at the same time retain customers.”

Part of the issue is that the very nature of how climate-related damages play out often violates key principles of insurability: insurance works best when risks are independent, meaning they don’t all happen at once, yet climate events tend to create clusters of risk. The California wildfires and the floods in Emilia-Romagna, Italy, are a prime example of the clustered nature of the exposure to risk in these regions, which makes it extremely difficult to offer adequate coverage to communities living in these areas.

“In a future mired by climate change, potential damages would be so high that either insurers do not want to provide coverage, or they would only do so for such high premiums that people would not be able to afford it,” says Ceolotto. “However there are solutions. For example, in the NATURANCE project we are actively working to bring together communities, climate change experts, financial players, and insurance companies in a common space for discussion and collaboration in the development of shared solutions.”

Examples of innovative insurance solutions include the development of parametric insurance products – non-traditional insurance products that offer pre-specified payouts based upon trigger events. Whereas traditional indemnity based insurance solutions rely on an exact damage assessment conducted on-site, parametric products use environmental and climatic data collected by third parties to verify the occurrence of conditions that trigger the payout.

This represents a different approach compared to traditional insurance and requires more sophisticated pricing models to link environmental data to the trigger and subsequently to the payout, which once again is not commonly employed in standard insurance policies.

Another solution lies in providing incentives – which could be in the form of discounts on premiums – for the implementation of risk-reducing measures such as installing flood-resistant barriers or waterproof walls for example. “For this to happen, the models used to calculate the price of the insurance policy need to be able to consider the risk reduction potential of measures so that the insurance premium can be determined accordingly,” says Ceolotto.

CMCC projects such as PIISA look to facilitate these kinds of innovations and create the conditions necessary for new solutions to emerge, as well as testing emerging insurance tools that can help address what is known as the insurance protection gap.

The insurance protection gap

When it comes to climate related risks, the insurance protection gap is growing and can be seen in the divide between the damage caused by extreme weather and the coverage available to pay for said damages.

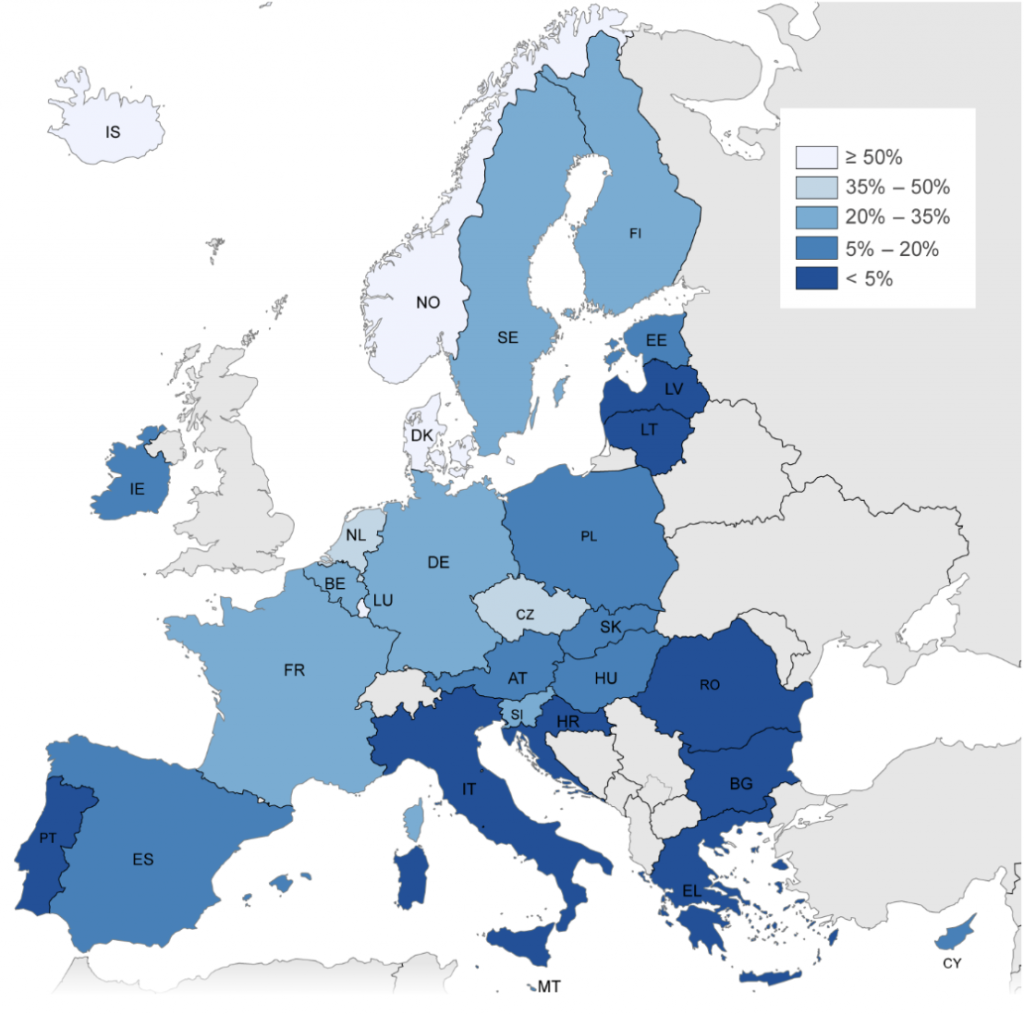

A widening gap implies that, as climate risks increase, more and more people and their assets find themselves without adequate protection due to either a lack of available policies or policies becoming unaffordable. The latest estimates by the European Insurance and Occupational Pensions Authority (EIOPA) reveal the climate insurance protection gap in Europe – namely the difference between insured and uninsured losses from climate-related catastrophes – to be around 75%.

“One major issue is also a lack of information. People are not always fully aware of their level of risk or the potential consequences of a certain event, or insurance may be too expensive, making it seem unattractive,” says Ceolotto, who is the lead author of the public deliverable on the role of insurance in climate adaptation, under the PIISA project. “Additionally, there is often a gap between perceived risk and actual risk: if someone believes that a catastrophic event will only occur once in their lifetime they might decide the risk is low enough to ignore it.”

A wide insurance protection gap can lead to serious consequences as it lowers the financial ability of people, communities and even entire economies to bounce back from disasters. A lack of insurance makes recovery more challenging.

Closing this gap requires a combination of better risk assessment, new insurance models, and policies that make coverage more accessible while encouraging climate adaptation. In this regard, science plays a key role and CMCC is at the forefront of efforts that work with all stakeholders – from insurance companies to policymakers and local communities – to find innovative and resilient insurance solutions.

A changing landscape

Extreme weather and climate events not only impact local communities but can also lead to significant macroeconomic implications, affecting the financial stability of governments that have to step in to provide relief or cover losses in the aftermath of a catastrophe.

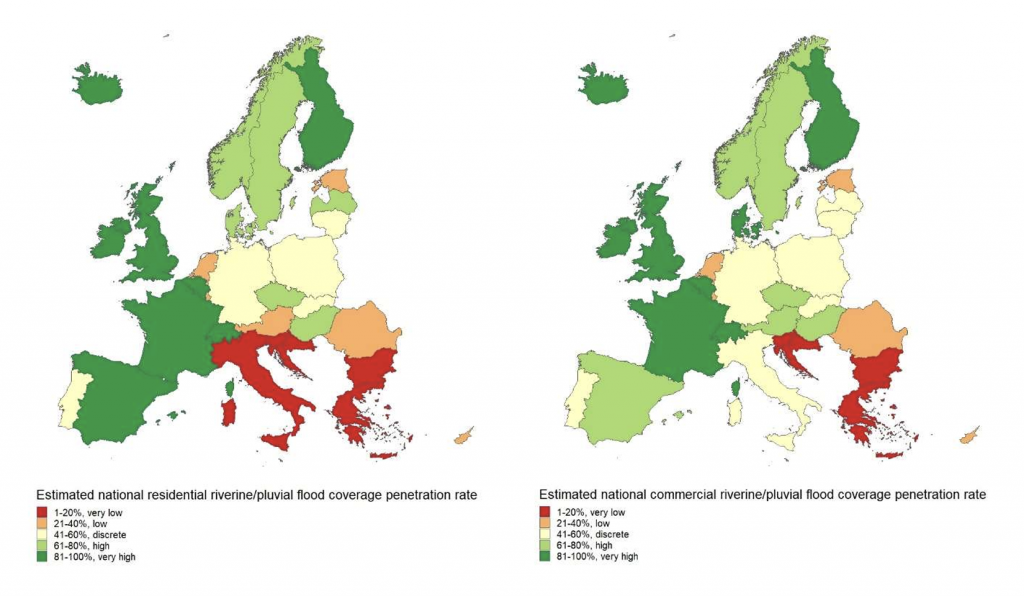

In Italy, as of January 1, 2025, a new law was introduced that obliges all businesses, regardless of their risk exposure, to buy insurance against natural hazards such as floods and landslides, whilst at the same time requiring insurance companies to provide such policies. In a first for a European country, the law provides a clear signal regarding the effects of climate change: climate losses have increased by 2.9% a year from 2009 to 2023, according to the European Environment Agency.

“The new Italian law has helped create an interest in innovative insurance products and hence also a scientific interest in the modelling for extreme events, as many insurance companies still don’t have the know-how to cover these events,” says Rianna, whose work with CMCC on the European Extreme Events Climate Index (E³CI) and The HuT projects is also geared towards providing solutions to these issues.

Finding innovative insurance solutions will involve a paradigm shift in the way we approach insurance itself. This will involve not only insurers and the financial sector, but rather a cohesive system that connects different players and assigns each one their portion of risk to manage, reducing the overall burden on individual entities.

“This is often referred to as a multi-level approach,” explains Ceolotto. “For example, policyholders bear a certain amount of risk. Up to a certain threshold, private insurance covers that risk, beyond which insurers transfer the risk to reinsurers, who then hedge it in global financial markets, as these are more able to assimilate risk. Finally, the most catastrophic risks are left to governments or supranational entities such as the EU Solidarity Fund in Europe, which is meant to cover catastrophic damages, although it is currently underutilized.”

In the Italian context, the new law is backed by a €5 billion reinsurance fund, set up by a state-controlled financial institution.

“What is necessary now is for insurance companies to rethink their models, especially for risks that were not previously covered as many economic operators already had insurance coverage for liability and other risks but without fully understanding what is actually insured,” explains Rianna.

Yes, insurers are required to offer policies, but the challenge of how to set premiums for risks they have not been covered historically remains. Returning to the example of Emilia-Romagna, which has suffered from three one in more than one hundred years flooding events in the last two years alone, how do you price insurance for that?

“There hasn’t been enough debate on the added value that these innovative policies could bring,” says Rianna. Under the E³CI project, Rianna is coordinating efforts to create a European climate risk index that helps develop actuarial sciences and natural sciences that deal with risk assessment in the insurance sector.

What are the potential applications? The first lies in identifying trends in the occurrence of extreme events in specific areas. The second revolves around conducting retrospective analyses to understand past events.

“The index does not seek to predict but rather to provide a key to understanding what occurred in the past,” explains Rianna. “For example, regarding the Emilia-Romagna floods in May 2023 and September 2024, we were able to analyze the extreme precipitation indicator for that region and determine how much it deviated from the climatological baseline. This helps assess how extreme the event was and, consequently, the likelihood of significant impacts, based on the assumption that the more extreme an event is, the greater the expected impacts.”

Integrated solutions

Insurance that focuses solely on financial instruments will not be enough. Neither will purely technological solutions, like installing sensors. The same goes for governance.

“We need holistic approaches that combine risk monitoring, modeling, financial tools, and local knowledge,” says Rianna. “Insurance should promote territorial protection, increase awareness, and integrate advanced monitoring systems. For example, insurers could lower premiums for policyholders who invest in risk mitigation, such as better land management. This would benefit both the insured and the insurer.”

This also involves turning towards alternative approaches such as nature-based solutions, as nature has intrinsic insurance value because it helps mitigate damage from weather events.

“At the moment, there are few policies that integrate nature-based solutions into commercial insurance products,” says Ceolotto, who also works on CMCC’s NATURANCE project. “Most policies currently on the market offer a discount on premiums in exchange for risk reduction measures. However, they don’t specify what those measures should be.”

NATURANCE looks to advance the development of innovative financial instruments to incentivize investment in nature, including insurance policies that specifically insure natural assets and the ecosystem services they provide. Today, there is a biodiversity finance gap of nearly 1 trillion USD, which current investments will not be able to bridge.

“New tools are needed to close this gap and encourage investment in nature,” says Ceolotto. “Insurance presents a major opportunity in this regard as it can help assign a clear price tag on the ecosystem services nature provides, capitalizing on them with lower insurance premiums.”

A common example is forest insurance. In this case, trees are insured, but most of these policies focus on compensating the economic loss – such as the loss of timber that can no longer be sold – rather than the loss of natural assets. These policies typically don’t cover reforestation but only compensate forest managers for lost revenue.

However, a new set of insurance products is also emerging that specifically protect ecosystem services. The best-known of this kind of products is the Mesoamerican Barrier Reef insurance program, a parametric policy whereby if hurricane winds exceed a certain speed, a payout based on wind intensity is triggered and can then be used to repair damage to the coral reef, thus ensuring that it continues to provide its risk reduction functions.

Nature-based approaches are just one example of innovative insurance solutions. Under The HuT, CMCC is working with partners to experiment with a suite of diverse tools that integrate technological, human and nature based solutions into insurance schemes.

There are currently two case studies being developed in Italy: one in Campania – where a semi-parametric insurance product that provides immediate post-event financial support is being tested; and another in Sardinia – where a community-based insurance model is being developed so that the insurer does not interact with individual farmers or businesses but with a collective entity that represents multiple stakeholders.

Ultimately, although these two initiatives – semi-parametric and community-based insurance – are being developed in parallel, each addressing different dynamics and stakeholders, they could also be combined depending on local needs and institutional structures.

“The key idea is that insurance should not only cover damages but also incentivize risk reduction through better land management. By maintaining the land, both the insured and the insurer benefit from reduced risks and costs,” concludes Rianna.