Critical raw materials form the backbone of high-tech products, renewable energy technologies, and other industrial applications. This means that for any green transition to be successful, there has to be a corresponding availability of critical raw materials. For the European Union (EU), this is becoming a worsening headache as these vital resources are sourced overwhelmingly from outside, leaving the bloc vulnerable to price volatility, supply disruptions, strategic dependence and even environmental concerns related to sourcing critical raw materials from countries with less stringent environmental regulations.

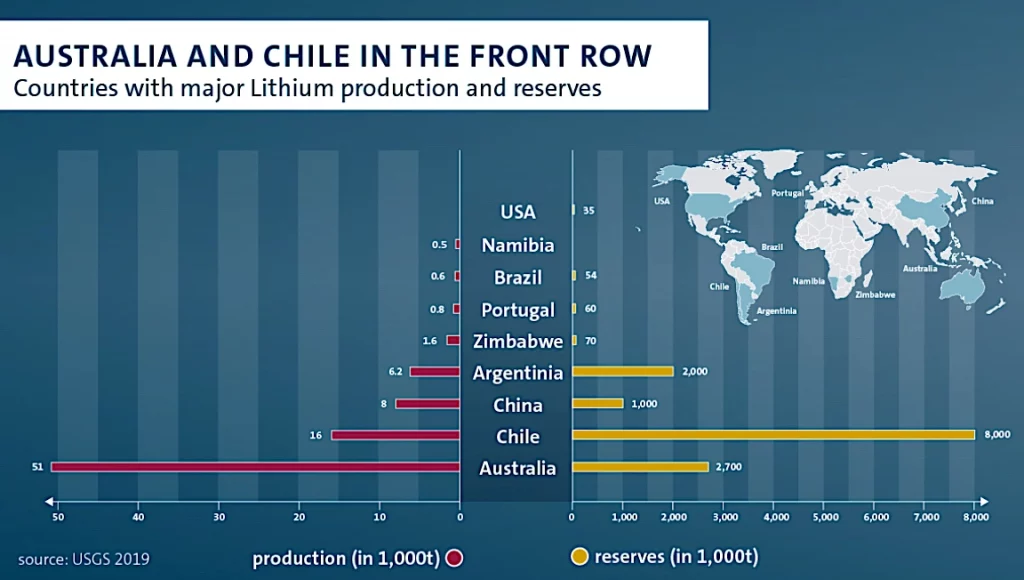

For example, EU demand for lithium – commonly used in electric-vehicle batteries and for energy storage – is expected to increase twelve-fold by 2030, with similar trends also expected with regards to other critical raw materials such as nickel, copper, and cobalt, all of which are imported into Europe and central to things like clean renewable energy production.

According to the ‘Metals for Clean Energy’ study conducted in 2022 by Eurometaux, the EU is currently undergoing a critical shortage in clean energy metals, which are needed for the countless clean energy projects that have already been commissioned. The report indicates that if the EU is to reach its clean energy targets, it will need 35 times more lithium and seven to 26 times the amount of rare earth metals in 2050 compared with today.

Liesbet Gregoir, the report’s lead author, states that: “Europe needs to urgently decide how it will bridge its looming supply gap for primary metals. Without a decisive strategy, it risks new dependencies on unsustainable suppliers”.

So, how is the EU planning to bridge this supply gap? On March 16, the European Commission announced the Critical Raw Materials Act (CRM Act), a legislative proposal intended to strengthen the EU’s autonomy in the supply of key raw materials in the aftermath of Covid-19 and the energy crisis following Russia’s invasion of Ukraine.

Through a “set of actions to ensure the EU’s access to a secure, diversified, affordable and sustainable supply of critical raw materials”, the CRM Act outlines the EU’s new strategy and, somewhat controversially, includes a focus on boosting mining activities and projects inside the Union.

Mining a reliable supply

With the EU looking to lessen its reliance on imports, and in particular on China which currently supplies about 95% of the EU’s rare earths, mining is seen as one part of the CRM Act’s multifaceted strategy – which also includes diversifying imports through trade actions and strategic partnerships, and investing in the recycling, processing and circular use of critical raw materials.

“Today’s communication aims to maximize our ability to access, process, refine, recycle and deploy critical raw materials,” said trade commissioner Valdis Dombrovskis as he announced the proposal.

“Our goal is that, by 2030, our capacity should reach at least 10% of domestic demand for mining and extraction, at least 40% for processing and refining and at least 15% for recycling,” he continued.

The mining aspect is perhaps the one that has raised the most controversy due to concerns about what implications this could have in terms of the environmental and human cost of mining, which for decades has largely been hidden from the EU’s direct view.

According to Chris Heron, director of communication and public affairs at Eurometaux, the key is to future-proof Europe’s supply chain and ensure that a lack of resources does not undermine its goals.

“Globally, the mining project pipeline isn’t keeping pace with the speed of the energy transition. There are major concerns about the availability of some of these resources in 2030, and there’s a big risk of bottlenecks or price increases,” he warned.

According to the Eurometaux report, Europe has the potential to satisfy up to 20% of its mining needs internally and process above 40% of specific raw materials. The CRM Act, therefore, looks to leverage this potential by tackling issues such as investment in mineral exploration and the delays and bottlenecks in permits for extraction, refining and recycling.

“Fast-track permitting should be allowed for projects regarded as having strategic importance to the bloc while still keeping high environmental, social and governance (ESG) standards,” said Chief Executive Bernd Schaefer of EU-funded EIT Raw Materials in the follow-up to the publishing of the CRM Act.

“In China, you get a permit for a mine in three months as opposed to 15-to-17 years in Europe,” Schaefer continued.

Mining in Europe?

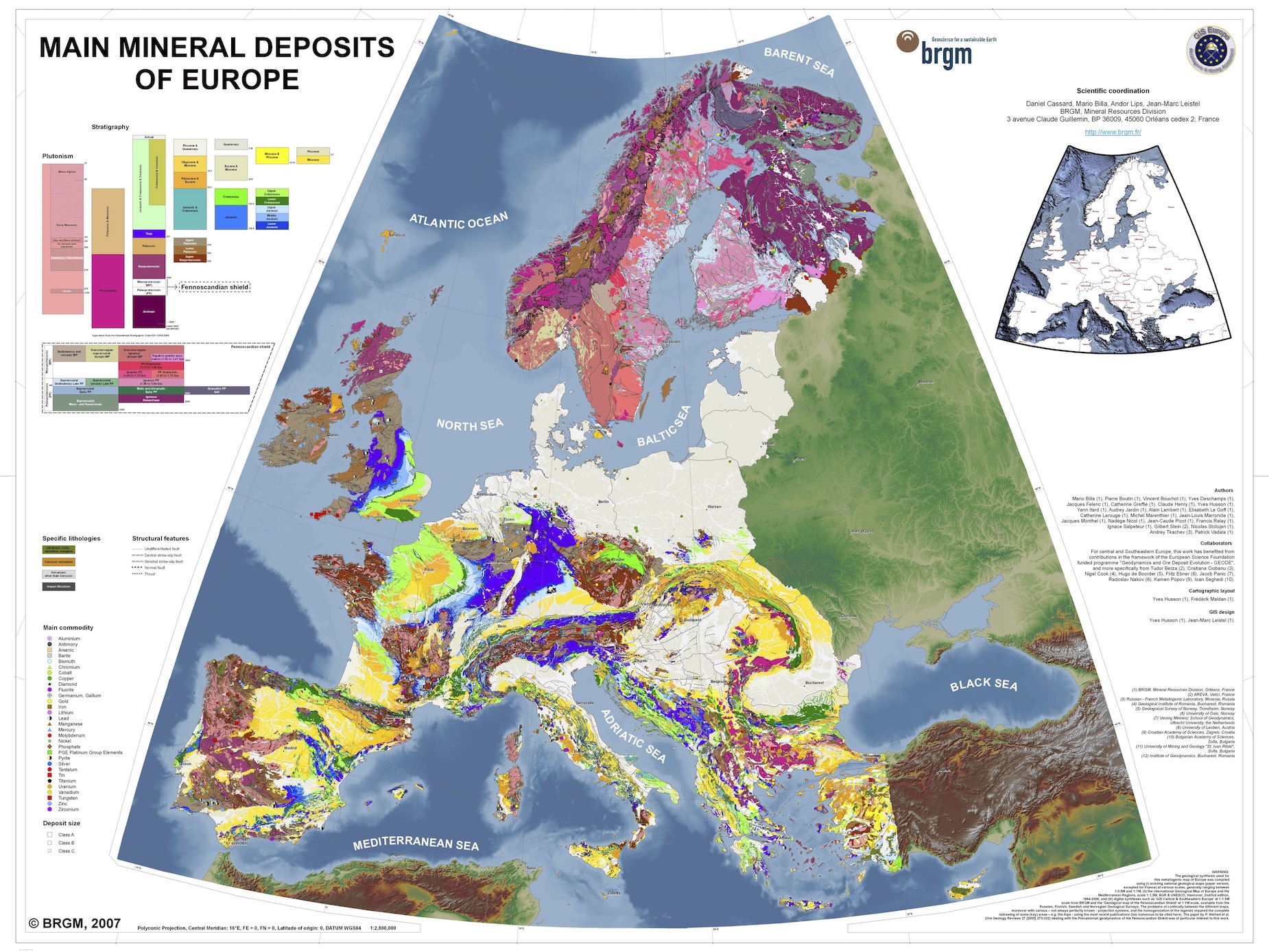

According to the European Commission’s 2020 list of critical raw materials, which includes 30 minerals and metals, the EU has significant reserves or resources of antimony, bauxite, cobalt, fluorspar, graphite, indium, magnesium, niobium, phosphate rock, platinum group metals, rare earth elements, and vanadium, among others.

However, the exploitation of these resources faces various challenges, such as high extraction costs, technical difficulties, environmental and social concerns, and competition from lower-cost producers in other regions.

Through the CRM Act, the EU aims to increase the sustainable and responsible mining of CRMs within its borders whilst also diversifying its supply sources through partnerships with other countries and regions.

The Act will try to tackle issues such as the lead time of potential mines, lack of local public support, and higher European labour and energy costs which currently affect new and planned mines in the region.

Opening a new mine in Europe typically takes between 10 to 20 years and large capital investments, making it difficult to meet the growing demand with a comparable increase in supply.

What is more, social and political opposition to the commissioning of new mines, as indicated by the mass public opposition to the Jadar lithium mine, which was to become one of the biggest in the world but has now been suspended due to environmental concerns, has been a strong inhibiting factor in pushing for more mining within the bloc.

Yet the CRM Act reveals the European Commission’s desire to allow mining projects that are considered to be of strategic importance to benefit from permitting deadlines of two years.

This could be particularly significant when it comes to materials such as lithium, where internal reserves could satisfy 25 to 35% of Europe’s demand by 2030, according to Michael Schmidt, a research associate at the German Mineral Resources Agency. This would greatly reduce the current dependency on Chile which supplies 78% of the bloc’s current lithium consumption.

Can mining go hand in hand with nature protection laws?

Conservationists have a long history of opposition to mining expansion in Europe, and although mining projects in protected areas will require additional impact assessments to get the go-ahead, opposition remains widespread.

NGOs and experts have come together to criticize the Commission’s new approach to mining and point to the fact that they are ignoring the environmental concerns of citizens in places such as Tréguennec, France, where protests against new mining projects have all but brought the plans to a halt. Other protests against new mining projects in Portugal, Germany, Sweden and Spain are also adding fuel to the fire.

🧐 Un important gisement de lithium a été découvert au milieu de la baie d’Audierne, près de Tréguennec, dans le Finistère Sud. La zone écologique, triplement protégée, est désormais convoitée par l’État. 👇https://t.co/kgZF9CS47f

— France-Soir (@france_soir) March 24, 2022

Yet, for others the fact that mining will come to Europe may even present an opportunity to source critical raw materials with less environmental damage.

“I think that the way that we mine in Europe is probably … one of the best ones in the world. But we don’t get permitted to do mining,” said Mikael Staffas, CEO and president of Swedish mining firm Boliden who also commented that Europe “happily [imports] metals from other parts of the world” that mine with far lower environmental standards.”

As new sources of critical raw materials are discovered across Europe, and legislation to facilitate their mining gains momentum, it appears that the EU will push for more internal sourcing of these materials.

Already, Swedish mining company LKAB plans to mine a recently discovered reserve of over one million tons of rare earths in the Kiruna area in the north of the country. “It is possible to drastically innovate mining and make it more attractive to Europe,” says Mike Buxton, Section Head for Resource Engineering at TU Delft in The Netherlands.

Although LKAB does not yet have a mining permit the CRM Act promises to facilitate these kinds of projects and that the process for permits and extraction will be streamlined. What this means for Europe remains hidden below the surface.

Cover picture: Roberto Sorin – Unsplash